Hey Freelancer, Operate Like A Corporation in <30 min [Bench Bookkeeping In-depth Review]

So, you're a freelancer or small business owner and you're struggling with your bookkeeping. Let's face it, it's not the most exciting thing there is, and it can get quite complicated sometimes but like they say, it has to be done.

The worst of all is that, while you do it, you spend hours that you could rather spend doing what you do best, that is, running your business and making more money.

Yet, it's crucial, as a freelancer or small business owner, that your bookkeeping is up to date because it saves you a lot of hassles and stress when it comes to tax season.

Oh, and don't forget about all the receipts you keep every month in that shoebox. How is it possible that that crucial receipt you need to balance your books always goes missing?

So, if you're tired of staring at spreadsheet cells trying to figure out formulas that calculate your tax, you may want to look at another, more efficient solution. If you do, and you want to solve your bookkeeping problem while making your system more efficient so that you can focus on your business and make more money, there are other, better ways to do this.

For one, you can consider accounting software.

There are many of these platforms available online that you can choose from with the promise of making your bookkeeping easier. You just enter your transactions in the system and categorize them yourself. The software then separates the transactions into different sections and can automatically generate financial reports for you. Although it could make your bookkeeping more efficient, it doesn't handle it for you.

This means you'll still need to spend time every month entering and categorizing transactions. And, like your beloved spreadsheets, if you make a mistake it will result in inaccurate books.

The next option is to hire a traditional bookkeeper. These bookkeepers may work independently as freelancers, in partnership with other bookkeepers or even as part of a large national firm. Either way, they can save you a lot of hassles. Although you'll still have to spend a few hours each month with the bookkeeper, you'll save a lot of time and effort compared to doing your bookkeeping yourself.

The big drawback with a traditional bookkeeper, though, is that they cost a lot more with most bookkeepers charging between $20 and $50 per hour and they often have a set monthly minimum. So, yes, you'll save time in which you can make more money for your business, but you'll end up paying a lot more.

That brings us to today's review, using an online bookkeeper. Here, we’ll look at Bench Bookkeeping that gives you a team of bookkeepers who do all your bookkeeping for you.

This means it automatically import transactions, categorizes them, and then bookkeepers prepare monthly financial statements for you. All the hard work that they do mean that you can track your finances anywhere you are.

Plus, you can communicate with them through the Bench app, so they’re always there if you need advice or have questions.

Now this sounds great! You save a lot of time and, yes, there is a cost, but typically far lower than a traditional bookkeeper. So, it sounds like a win-win for you. But is it really worth it or should you stick to keeping doing it yourself or using accounting software to save money? As a bonus, if you register for a free trial and if you decide to continue with Bench after your free trial, we’ll give you 30% off your first 3 months of service, just for being a friend.

Let's take a look.

Table of Contents in Detail Hide

Why Bookkeeping Is Important?

Before looking at what Bench is, and how it works, let’s briefly take a look at why bookkeeping is important for you as a freelancer or small business.

One of the most important reasons why proper bookkeeping is important is that it allows you to budget. A budget helps you to create a financial roadmap for your business and with this map, you can plan for future expenses and anticipated income. So, when your income and expenses are correctly organized, it simply makes it easier to review your financial position and budget properly.

As a result, bookkeeping makes your business planning smoother and more manageable. In fact, you only need your balance sheet, or your profit and loss statement to show you how strong your business is financially. With this in mind, you'll be able to plan better and decide what expenses you can afford.

These financial statements also let you see how your business is performing. So, apart from planning, you can assess your business's performance and you'll be able to identify your strengths and weaknesses. For the weaknesses you identify, you'll then be able to make improvements to your business processes.

Ultimately, once you know where your business is financially and what your plans are, you'll be able to make better decisions regarding your business.

Now, these reasons all sound like great motivators, but apart from these, proper bookkeeping also helps you to get your tax affairs in order. By knowing that your bookkeeping is in order when the time comes to file your taxes, you’ll sleep easier at night knowing that there won't be any nasty surprises.

What is Bench?

Simply put, Bench Bookkeeping is an online bookkeeping service that handles freelancers’ and small businesses’ bookkeeping for them. It pairs intuitive software with real bookkeepers to take the hassle out of bookkeeping and give entrepreneurs more time to focus on running their businesses efficiently. This means they'll categorize transactions, reconcile bank accounts and prepare financial statements on behalf of the freelancer or business.

How Does Bench Accounting Work?

So, how do you get all this bookkeeping goodness? Well, it's quite simple. After you sign up for an account, Bench will introduce you to a dedicated bookkeeper who’ll get to know your business, show you how Bench works and will gather everything they need from you.

You then connect your financial accounts like your bank accounts, credit cards, loans, and merchant processors, and during this process, your bookkeeper will categorize your transactions, reconcile your bank accounts and prepare financial statements for each month within 15 days. If during the process the bookkeeper needs any more information from you, they'll get in touch with you.

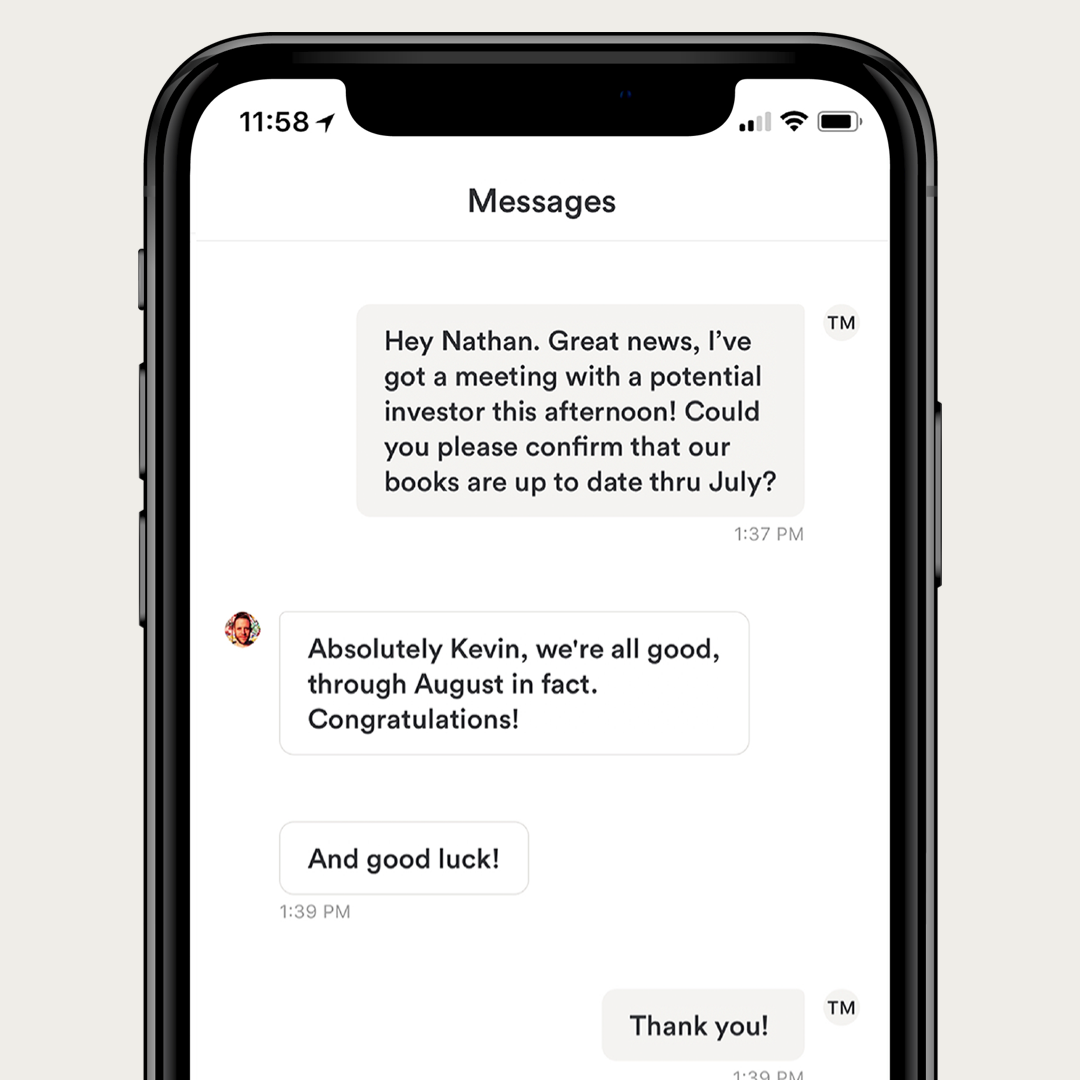

Once your books are done, you'll receive a message through the app, and at that point, you can view your financial statements and your account information online or through the app. You'll also be able to get in contact with your bookkeeper if you have any questions or queries at that stage.

Ultimately, Bench helps you to track your business health and with monthly financial reporting. In this way, you'll always know where your business is at financially and how your cash flow looks like. The best way to try it is to register for a free trial. If you decide to continue with Bench after your free trial, we’ll give you 30% off your first 3 months of service, just for being a friend.

Now, the question is obviously what happens if you join you need to get your books up to date. Here, Bench’s catch-up bookkeeping service gives you the option to get your books up to date if you have less and two years of historical bookkeeping. If you need more than two years, it also offers you the option to work with their Bench Retro team to get your books up to date.

Personal Story with Bench

Bench Features

As you've probably realized by now Bench takes the pain out of your bookkeeping and saves you time and money in the process. With that in mind let's look at some of its standout features.

Dedicated bookkeeper

With Bench you get a team of three bookkeepers including a senior bookkeeper who reviews all monthly statements and the year-end financial package. Your team of bookkeepers is also supported by small business experts that can answer any questions you have about your business.

Your team of bookkeepers will reach out regularly with updates and it's easy to book a call with your bookkeeper directly through the Bench app. Ultimately, this means you have more time in your day that you can spend on running your business and making more money, while also having great insight into the finances of your business.

Real-time reporting

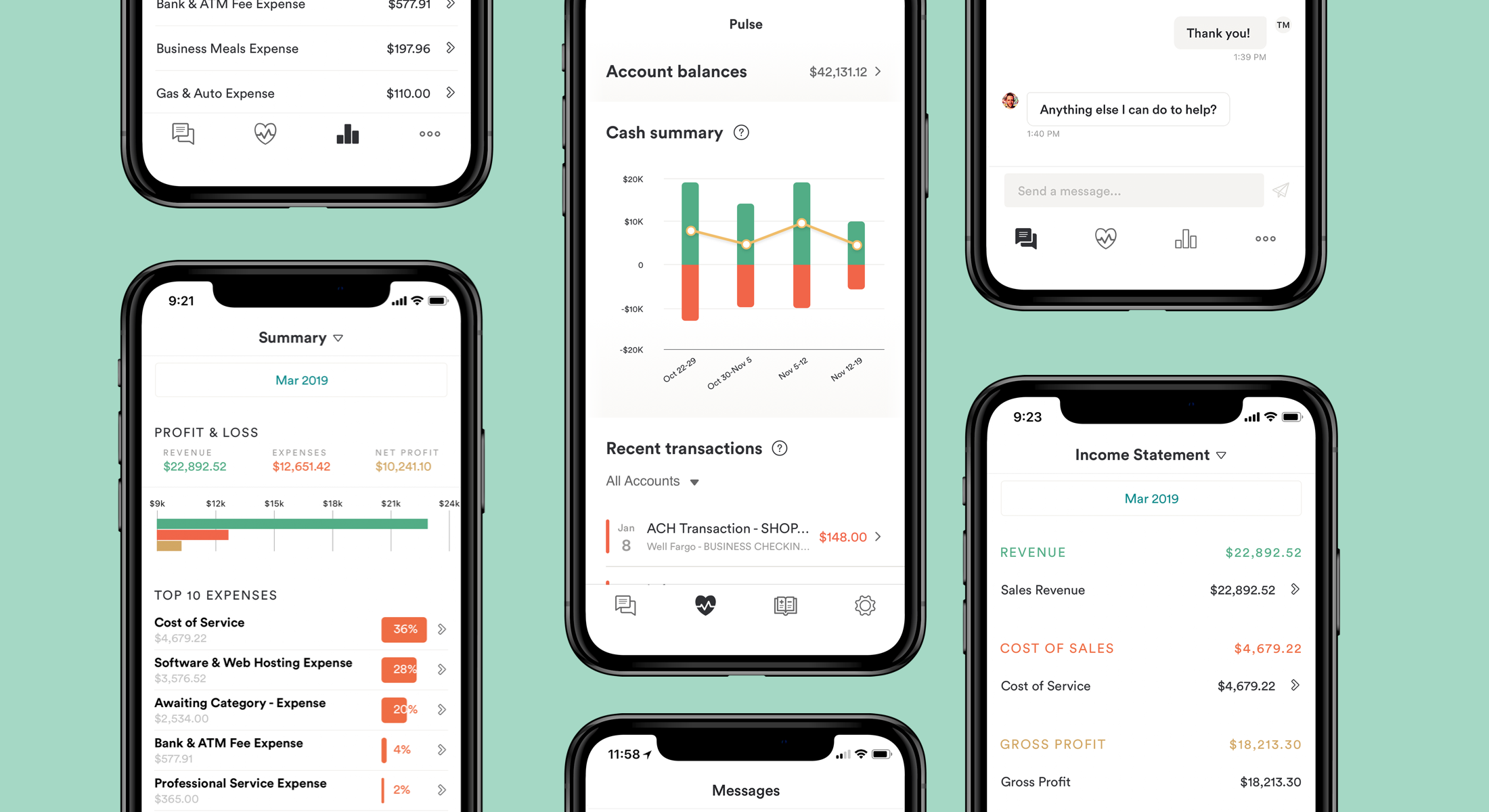

The Bench Pulse Dashboard enables you to track every transaction, account, and business trend without going from platform to platform to get the information you want.

This gives you the ability to see your income statement, balance sheet, and visual reports that show you exactly the data you need to grow your business. And as controlling spending is part of growing your business, with Bench you’ll be able to manage your expenses efficiently.

You're also able to tag transactions with labels so that you can see where you're spending and how your business is performing.

Tax Support

Bench can connect you to a tax professional. Its Bench Tax feature gives you an all-in-one tax and bookkeeping solution that promises to simplify your tax preparation with year-round tax support.

It's quite simple too. Every month your bookkeeper imports your business transactions and does your bookkeeping. When the end of the year comes, your bookkeeper will prepare a tax package that contains everything you need to file. When you're ready to file, your dedicated tax coordinator will collect all the necessary documents and forms and then Bench will connect you to a tax practitioner to get your taxes filed on time.

This is a vital feature of the platform because you face the possibility of several penalties if you file late or miss the tax payment deadline. Some of these penalties include:

Filing your taxes late.

If you file your taxes more than 60 days after the due date or an extension date if you asked for one, the minimum penalty is $205.00. If your taxes are less than $205.00, then you pay 100% of your tax amount.

Paying your taxes late.

For every month that you pay late, you’ll have to pay an additional 0.5% of the unpaid tax amount up to a maximum of 25% of your total tax bill.

Filing and paying late.

If you file and pay late, you'll have to pay a 5% per month interest fine.

Paying your taxes late after an Issuance of Notice.

If the IRS finds that you owe more taxes than you originally calculated, they'll send you an Issuance of Notice to request the additional payment. If you fail to pay within 21 days, you’ll have to pay a 0.5% interest on the owed amount.

Submitting a form late.

If you submit a form late, the fine is a maximum of $50.

In addition to these penalties, you’ll also be liable for mistake penalties where, for example, you calculated your taxes too low. Here, if you substantially underestimated how much tax you owe or the IRS finds that you were negligent in calculating your taxes, you'll face a 20 to 40% increase in your taxes owed.

Considering this, the price you pay for Bench Bookkeeping is worth this benefit alone.

The feature doesn't stop with tax season though and they offer year-round tax advisory services and their in-house tax professionals are always on hand for all your tax planning needs.

Catch Up Bookkeeping

Another innovative feature of Bench is that they offer you the option to get your books up to date if you're behind. So, if you're missing months or years of bookkeeping, Bench lets you get back on track and they'll do your overdue books with total accuracy.

Like their standard package, your Bench bookkeeper works with a supporting team to complete your overdue books and when it's done, every month of your historical bookkeeping is peer-reviewed to ensure that it's accurate and tax ready.

Security

At Bench, they take privacy and security seriously and they’re committed to protecting your information with the highest standards of security available. As such, they protect your data with 256-bit SSL/TLS encryption and every Bench employee goes through a rigorous clearing process including multiple interviews and a criminal record check.

This is the same type of security that banks use so you can be sure that your account information in the Bench app is always protected.

Accessibility

With Bench you have access to your financial information at any time, no matter where you are. You can see your business’s finances through the Bench app or on your computer, which makes it easy to budget, plan, and make better decisions.

Bench Pricing

Bench has several pricing options available depending on your monthly expenses. So, in other words, to get an idea of what the right plan for you would be, you would need to calculate, on average, how much you spend every month on goods and services that are necessary to your business.

So, you have to include any payroll or cost of goods sold in your estimate. If you've paid yourself a draw out of the business, you don't need to include this in your expenses, though.

Once you've calculated your average monthly expenses, you can look at the plans that Bench offers.

Here, they offer the following plans:

The Starter Plan is priced at $159 per month if billed annually, and if you pay on a monthly basis, the price goes up to $189 per month. This plan is recommended for freelancers or businesses that have expenses below $3000 per month.

Next up is the Micro Plan, which is priced at $199 per month if paid annually, and the price goes up to $219 per month if you pay monthly. This plan is recommended for businesses or freelancers with monthly expenses between $3000 and $20,000.

Next is the Boutique Plan which is priced at $249 per month if billed annually. If you choose to pay monthly, the price goes up to $279 per month. This is the recommended plan for freelancers or businesses that have monthly expenses between $20,000 and $50,000.

Next up is the Venture Plan, which is priced at $299 per month if you pay annually. If you pay monthly, the price goes up to $359 per month and this is the recommended plan for businesses with monthly expenses between $50,000 in $100,000.

The last plan is the Corporate Plan which is priced at $419 per month if billed annually, and the price goes up to $499 per month if you pay monthly. This is the recommended plan for businesses or freelancers that have monthly expenses between $100,000 and $1 million.

Each plan, irrespective of price, comes with its own bookkeeper and intuitive software that you can use to track your finances. The plans include monthly bookkeeping for up to 15 financial accounts and if your business requires more accounts or additional services, it may be necessary to get a custom price from Bench.

In addition to these plans, it's also possible that you can get specialized bookkeeping from Bench, especially when your business needs to track cash revenue, cash expenses, accounts receivable, accounts payable, or segment level bookkeeping. In the event that this happens, a Bench expert will help you to determine if your business requires specialized bookkeeping, and if you do, pricing starts at just $100 per month which is an add-on to any other payment plan.

In addition, if you want to add the Bench Tax feature to your plan, you'll have to pay $99 per month if you pay annually. If you pay monthly, the price goes up to $229 per month. With this package, you'll get tax advisory, unlimited state filings, federal income tax filings, quarterly estimates, and year-round tax support from a licensed tax professional.

If you're not sure if Bench is the right platform for you, Bench also offers a risk-free trial before you sign up. In fact, they promise that they'll never recommend their services if they’re not the best solution for your business. So, they'll do a month of your bookkeeping and give you your income statement and balance sheet during the free trial. So, why not try a free trial. If you decide to continue with Bench after your free trial, we’ll give you 30% off your first 3 months of service, just for being a friend.

If you own more than one business that you want accounting for, Bench also offers you the option to receive customized monthly or annual subscription rates for them to do the bookkeeping for these businesses. And, as a value add they also review your plan annually to make sure that you have the right plans for your needs.

Lastly, with Bench you can cancel anytime, and they make it easier for you to get all your data out of the platform.

Pros and Cons

By this time, you probably think that Bench is perfect for your bookkeeping needs. However, like with many things in life, there are pros and cons to using it for your bookkeeping.

Pros:

Saves you time.

This is probably the biggest advantage of using Bench. This is simply because, once you link your accounts, Bench takes care of the rest. This means there's no longer any manual processes and that you'll have to spend hours each month on your bookkeeping yourself. Even compared to accounting software it’s still a lot faster because, although accounting software doesn't necessarily require much in the way of manual processes, you'll still have to manually enter all the details into the system. Also, with Bench there's no need to manually send any documents and the team will complete your bookkeeping within 15 business days after the end of the month. Because your team has the ability to ask you questions about a particular transaction with an in-app message, there's no need to communicate by phone or through email which also saves you time and hassles. This saves you a lot of time.

Easy to use.

The Bench app lets you view your monthly financial reports, visual summaries, and cash flow all on one platform. You can also use it to message your team at any time when you need any answers, or you have questions. This makes the entire system easy to use and intuitive so you don't need tons of training before you can effectively do your bookkeeping with the Bench app.

Provides reliable support.

Apart from access to your own team of bookkeepers to review your financial statements and your year-end financial package, you always have experts on hand to answer your questions or when you need advice. Here, you simply send a message from your computer or the app through the platform, and your bookkeeper or one of the team will reply within one business day. It's also possible in the app to schedule a time for your bookkeeper to call you at no additional charge.

Catch-up bookkeeping available.

This is especially helpful if you have overdue bookkeeping that needs to be done. It's so fast, it can finish a years’ worth of bookkeeping in two to four weeks, something that would take you literally months to complete. So, for an additional fee, this is totally worth it.

Bench Tax.

Through the Bench Tax feature, you have access to tax services so that all your taxes are handled and filed on time. This means you have your monthly bookkeeping, financial reports, and taxes all in one place which makes it easy for you to see or business’s financial health.

Monthly financial reports.

With these and your year-end financial reports, you have all the information you need to take your business’s performance to the next level. It’s simple, with this information in hand, you'll be able to plan better and make better business decisions.

Affordable.

Compared to the options outlined above, Bench is an affordable option. Sure, some accounting software packages may be cheaper, but you'll have to do a lot of the heavy lifting yourself and the software only basically keeps a record of your transactions. Also, other bookkeeping services charge on a sliding scale based on the number of accounts or your revenue, while Bench prices are based on your monthly expenses. In addition, for the price you're paying, you'll get access to 15 financial accounts, including bank accounts, credit cards, loans, and merchant processes. In contrast, for many other competitors only include a handful of accounts in their entry-level plans and if you want to include more, you'll pay for the more expensive accounts.

Cons:

Doesn't work well with paper record keeping.

Bench is a truly digital platform that works with digital records, so, if you have a lot of paper receipts and other records that need to be entered into the books, Bench may not be the perfect option for you. Alternatively, they do offer a very simple way to email receipts to the Bench team with a unique email they provide you to add the receipt to your books.

May feel unfamiliar.

If you're not used to doing accounting or banking digitally, but rather doing it in person, and you're not super comfortable with online services, Bench may not be the right option for you.

Difficult to switch providers.

Bench uses their own proprietary software that you use to import your financial accounts and it gives you your financial statements. Unfortunately, this doesn't sync up with popular accounting services like Quickbooks, Xero, or other accounting software. So, this makes it difficult to switch bookkeeping services, later on, should you wish to do so. It also means that, if you want to try a tool like Quickbooks or Xero later down the line, it could cost you a lot more time and money to format and import all the financial information you need from Bench. If this is truly a concern for you, you could try a service like Quickbooks online with the live bookkeeping services add-on. This system connects you to a live, certified bookkeeper that can help you with your books. You should just keep in mind, though, that it's more expensive than Bench accounting although the platform is more scalable and widely used.

Tax filing services not included.

Although Bench offers some tax support, they won't actually file your taxes for you unless you pay an additional cost for the Bench Tax or find your own accountant. In the long-term, this is actually a healthy separation but is important to keep in mind as you budget for your bookkeeping.

Is Bench Bookkeeping Right For You?

As with most things in life, there's not a simple answer to this question. As we've said, when you want to do proper bookkeeping for your business, you have several options available. You can do it manually, you can do it with accounting software, you can hire a bookkeeper, or you can use a service like Bench.

Now each one of these has its own pros and cons that you have to consider if you want to find the right solution for you.

Considering this, if you have a lot of books and many accounts, so typically a larger business, Bench may not be the right option for you. However, as a freelancer or a small business that only has a few accounts, Bench may just be the perfect option for your bookkeeping needs.

Considering its features, its benefits, and its pricing, it may well be one of the best investments you’ll make in your business for some time to come.

So, why not try them out and sign up for a free trial. That’s how I started. If you decide to continue with Bench after your free trial, we’ll give you 30% off your first 3 months of service, just for being a friend.